It’s time to think about your B2B payment process upgrade seriously!

Based on more than 10 years of experience building eCommerce for B2B businesses, we evaluate the choice of B2B payment method as an important factor. Because this greatly affects the “charm” of your merchant business.

Payment is always an important part of any transaction. Consider these facts:

- 1 in 3 shoppers say they would abandon their cart if their primary payment method weren’t available. (1)

- 1 in 6 have abandoned checkout because the process was too long or complicated. (2)

- 51% of businesses say the complexity of managing multiple payment solutions/partners is a serious challenge. (3)

Reference list:

(1) FIS Worldpay (2021), Shopping Trends Every Retailer Needs to Know, https://www.fisglobal.com/en-gb/insights/merchant-solutions-worldpay/article/does-your-brand-meet-customers-omnichannel-expectations

(2) Baymard Institute (2022), Reasons for Abandonments During Checkout, https://baymard.com/lists/cart-abandonment-rate#why-users-abandon-their-cart. Accessed 24th March 2022

(3) FIS Worldpay (2021), Global Payment Risk Mitigation, https://offers.worldpayglobal.com/global-payment-risk.html

Therefore, as a buying business, they always consider ease of payment including suitable payment methods, negotiable payment terms, etc. when choosing to transact with a supplier or a manufacturer. In many cases, company policy dictates which B2B payment method must be used, and business customers must find a supplier that accepts the process they need to complete their purchase.

Therefore, you can provide an excellent product or service but not meeting the customer’s payment requirements can cause you to lose a potential business deal!

Review 5 most common B2B payment methods

1. Checks

While checks are rather antiquated for B2C transactions, they remain a common form of payment in B2B sales. Checks do have many bonuses, the first being a clear paper trail throughout the payment cycle, which in some ways is why companies like them so much. However, there are downsides. Human error in composing the check will at times require a new check to be cut. Checks that bounce create a system of consequences to be handled. The amount of people involved in the process increases overhead. Finally, clearing checks takes a long time.

2. ACH

An ACH is essentially the electronic version of writing a check. In this transaction, the payment is pulled from the buyer’s bank account and deposited into the seller’s account. This works well with scheduled recurring payments between businesses. Authorization must be obtained from the buyer to establish this system, however, not all businesses are willing to provide their bank information. That said, this is a one-time setup, and going forward the payment happens with little to no effort for either party. ACH can be set up with companies who do not want scheduled payments, but regular purchases on an as-needed basis.

3. Credit Cards

Charging a card is a long-standing method of payment. This payment method tends to be a reliable way to ensure payment can be accepted, however, credit cards are notorious for high fees on both sides of the transaction. Credit cards also have spending limits, which can be a problem for high-volume business sales.

4. Wire transfer

This standard payment system has been around for a long time. Wire transfers involve money moved from one bank account to another through a “wire.” While safe, as far as ensuring sufficient funds are available is concerned, wire transfers require many steps to set up and execute. Wire transfers do not typically have currency limits on transaction exchanges.

5. Electronic Funds Transfers

A growing payment method, electronic funds transfer (EFT) is a digital payment. The function is not different from an ACH or wire transfer – in fact, those two payment options are forms of an EFT. EFT is a payment solution that efficiently transfers funds at a lower cost, and a faster rate than wire or ACH transactions because it is entirely digital. As automation rises, payment solution providers favor EFT. According to ystats, 59% of 2018 payments among three global regions were made electronically.

These approaches have been tried and true for decades. Vendors frequently take them straight away, thus they are an obvious solution for many small enterprises that don’t want to upset the apple cart. However, it is wasting human resources by requiring dozens of manual tasks.

Perhaps it’s time to shake things up and explore switching to digital payment platforms.

Reduce aging and enhance cash flow with variReceivable

Besides offering a variety of payment methods, providing your customers with an automation tool is a big plus. These tools can help you easily manage Account Receivables, whereas, customers can manage Account Payables.

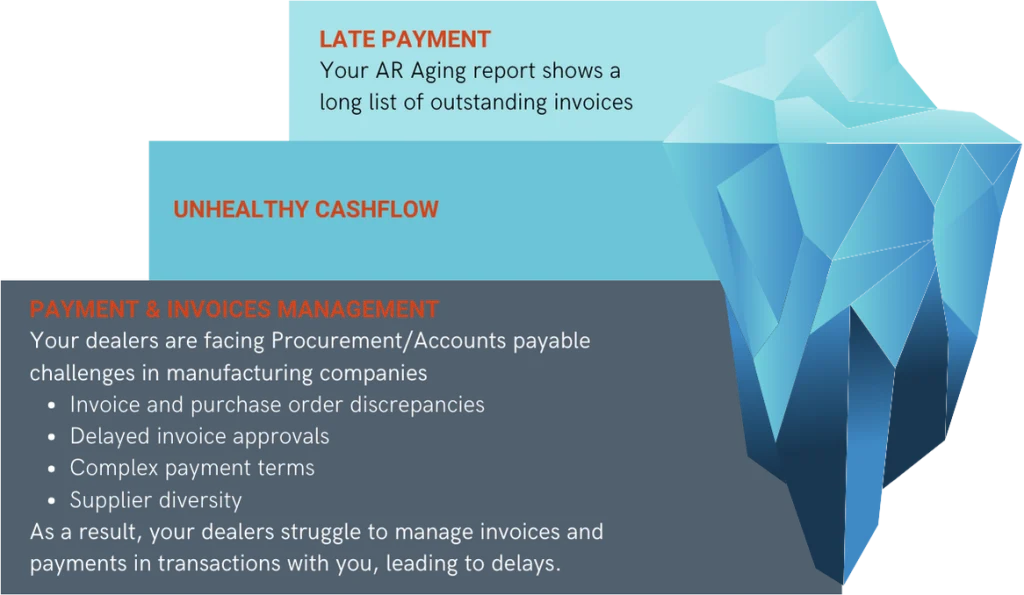

If you are facing unhealthy cash flow, your problem is not only late payments!

Take a sneak peek into your clients’ AP/Procurement process and see how they are struggling:

1. Identify which goods and services the company needs.

2. Submit a purchase request.

3. Assess and select vendors.

4. Negotiate price and terms.

5. Create a purchase order.

6. Receive and inspect the delivered goods.

7. Conduct three-way matching.

Accounts payable should conduct three-way matching by comparing the purchase order, order receipt or packing list, and invoice.

8. Approve the invoice and arrange payment.

If the three-way match is accurate, approve and pay the invoice. Businesses should strive to have a consistent invoice payment process through accounts payable that checks that payments match the invoice amount and due date.

They have to make sure invoices are always paid on time, which can prevent late fees and build good relationships with suppliers.9. Recordkeeping.

9. Recordkeeping.

Maintaining records for the entire procurement process is important, from purchase requests to price negotiations, invoices, receipts, and everything in between.

These records may be useful for multiple reasons. They help the company reorder goods at the right price in the future, as well as assist with auditing processes and calculating taxes. Clear, accurate records can also help resolve any potential disputes.

In conclusion, unhealthy cash flow and late payments are just the tip of the iceberg. The real challenge lies in managing invoices and payments for your customers.

FAQ’s

Electronic Funds Transfers (EFT) are considered highly efficient due to their speed, lower cost, and digital nature.

Checks provide a clear paper trail, which is beneficial for record-keeping and auditing purposes, despite their slow processing time.

Automation reduces manual tasks, minimizes errors, and ensures timely payments, thus improving cash flow and operational efficiency.

High fees and spending limits make credit cards less ideal for high-volume business transactions.

Three-way matching involves comparing the purchase order, order receipt, and invoice to ensure accuracy before approving payment.

Understanding the procurement process allows suppliers to align their payment methods with the client’s needs, ensuring smoother transactions and better relationships.