Introduction

In the competitive landscape of B2B commerce, maintaining a robust cash flow is not just an operational target; it’s a strategic imperative. Accounts receivable (AR)—the sales made but not paid for—stand at the heart of this financial dynamic. AR can be a source of strength and stability for a business when managed adeptly. This article delves into advanced strategies for optimizing AR collection with QuickBooks to enhance cash flow.

The Significance of AR in Business Operations

Accounts receivable are a reflection of a company’s liquidity. They are an indicator of sales effectiveness and customer relationships. However, when these accounts are mismanaged, they can quickly become a liability, tying up funds that could otherwise be used for growth initiatives or operational expenses.

QuickBooks: A Tool for AR Optimization

QuickBooks, a comprehensive accounting software, offers a suite of features designed to streamline AR management. From invoice creation to payment processing, QuickBooks provides businesses with the tools necessary to manage their receivables efficiently.

Strategic Invoice Management

The journey to optimized cash flow begins with strategic invoice management. QuickBooks allows businesses to:

- Create professional and clear invoices with customized templates.

- Set up recurring billing for regular clients, ensuring timely invoicing.

- Implement electronic invoicing to expedite the delivery and payment process.

Enhancing AR Collection

A proactive approach to AR collection can significantly enhance cash flow. QuickBooks supports this by:

- Enabling automated payment reminders that prompt customers to settle their dues.

- Offering online payment solutions that facilitate faster transaction completion.

- Allowing businesses to track invoice statuses in real-time, identifying overdue accounts swiftly.

Data-Driven AR Decisions

Data is a powerful ally in AR management. QuickBooks helps businesses make informed decisions by:

- Providing detailed reports on AR aging, helping prioritize collection efforts.

- Analyzing payment trends to forecast future cash flow and adjust credit terms.

- Monitoring customer payment histories to identify potential credit risks.

Risk Mitigation in AR

Mitigating risk is essential in AR management. QuickBooks aids businesses in this area by:

- Allowing for credit checks and setting credit limits based on customer history.

- Generating insights into AR turnover, offering a clear picture of liquidity.

- Facilitating the reserve for doubtful accounts, and preparing for potential bad debts.

How can companies handle disputes related to unpaid invoices effectively?

Handling disputes over unpaid invoices is a delicate process that requires tact and a clear strategy. Here are some effective steps companies can take:

- Prompt Communication: Address the dispute as soon as it arises. Open a dialogue with the customer to understand their concerns and clarify any misunderstandings1.

- Review Contract Terms: Examine the contract or agreement for terms related to disputes and invoicing. Ensure that both parties are aware of their rights and obligations1.

- Document Everything: Keep detailed records of all communications, agreements, and transactions related to the disputed invoice. This documentation can be crucial if the dispute escalates2.

- Offer Solutions: Be flexible and propose solutions such as payment plans, discounts for early payment, or partial payments for the undisputed amount.

- Mediation Services: If the dispute cannot be resolved internally, consider using a third-party mediation service to facilitate a fair resolution.

- Legal Action: As a last resort, legal action may be necessary. However, this can be costly and time-consuming, so it’s often better to try to resolve the dispute through negotiation and mediation first.

Remember, maintaining a positive relationship with the customer should be a priority throughout the dispute resolution process. Effective dispute management can even lead to stronger customer relationships in the long run.

Leveraging Technology for B2B Payments

In the digital age, B2B payments have evolved. QuickBooks stays ahead of the curve by:

- Integrating with various payment gateways for seamless transactions.

- Supporting electronic funds transfer, reducing the reliance on traditional checks.

- Providing mobile payment options, catering to the needs of on-the-go clients.

Conclusion

Effective AR management is a multifaceted endeavor that requires a strategic approach and the right tools. QuickBooks offers a robust platform for businesses to enhance their AR collection processes, thereby optimizing cash flow. By leveraging the advanced strategies outlined in this article, B2B companies can ensure that their accounts receivable contribute positively to their financial health and operational success.

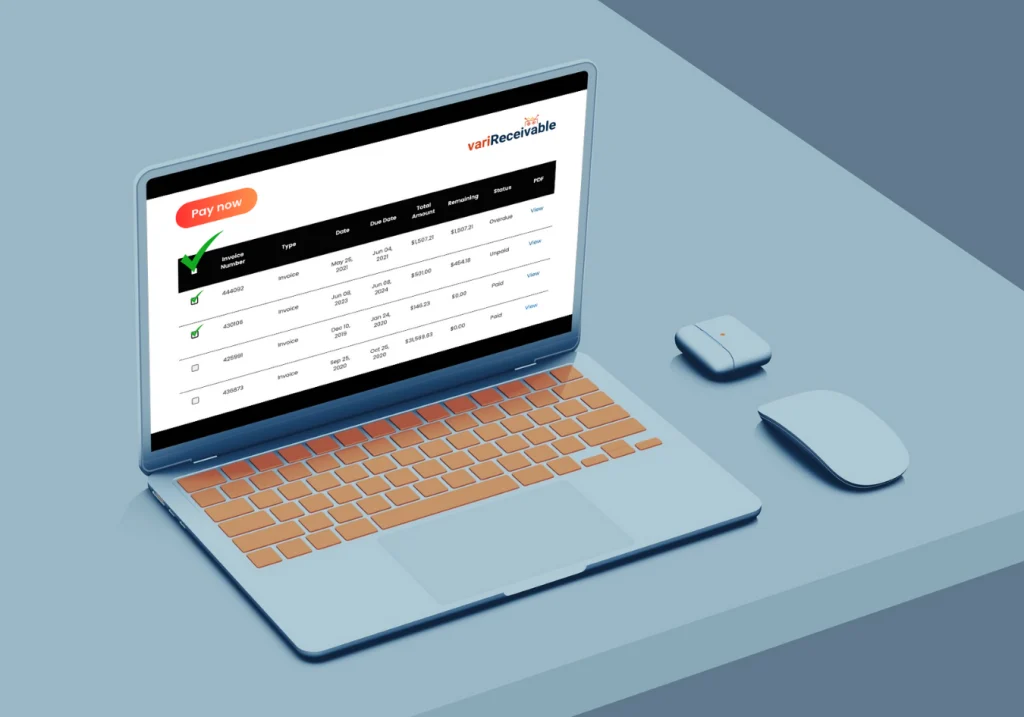

Upgrade QuickBooks power with our variReceivable

The journey to optimized cash flow begins with strategic invoice management. In today’s interconnected business environment, the challenge of managing accounts receivable and avoiding disputes over unpaid invoices is a common concern. Recognizing this, variReceivable offers a solution designed with simplicity and efficiency in mind. Our B2B payment portal provides a centralized location where the B2B buyers and their AP accountants can effortlessly handle all their invoices.

By choosing variReceivable, businesses can enjoy a streamlined process that not only saves time but also fosters better communication with their partners. It’s a thoughtful approach to a complex issue, offering a practical way to keep financial records in order and disputes to a minimum. We invite you to experience the benefits of our portal and see how it can make a positive difference in your day-to-day operations.